Behind the Wheel: The Importance of Vehicle Trade Insurance for Remote Workers

Lately, the concept of remote work has revolutionized the way a lot of people manage their careers. With developments in technology and a rising acceptance of telecommuting, individuals across multiple fields are finding new ways to handle their jobs from the convenience of their homes. For those in the auto sector, this shift brings specific opportunities and challenges, particularly when it comes to insurance considerations.

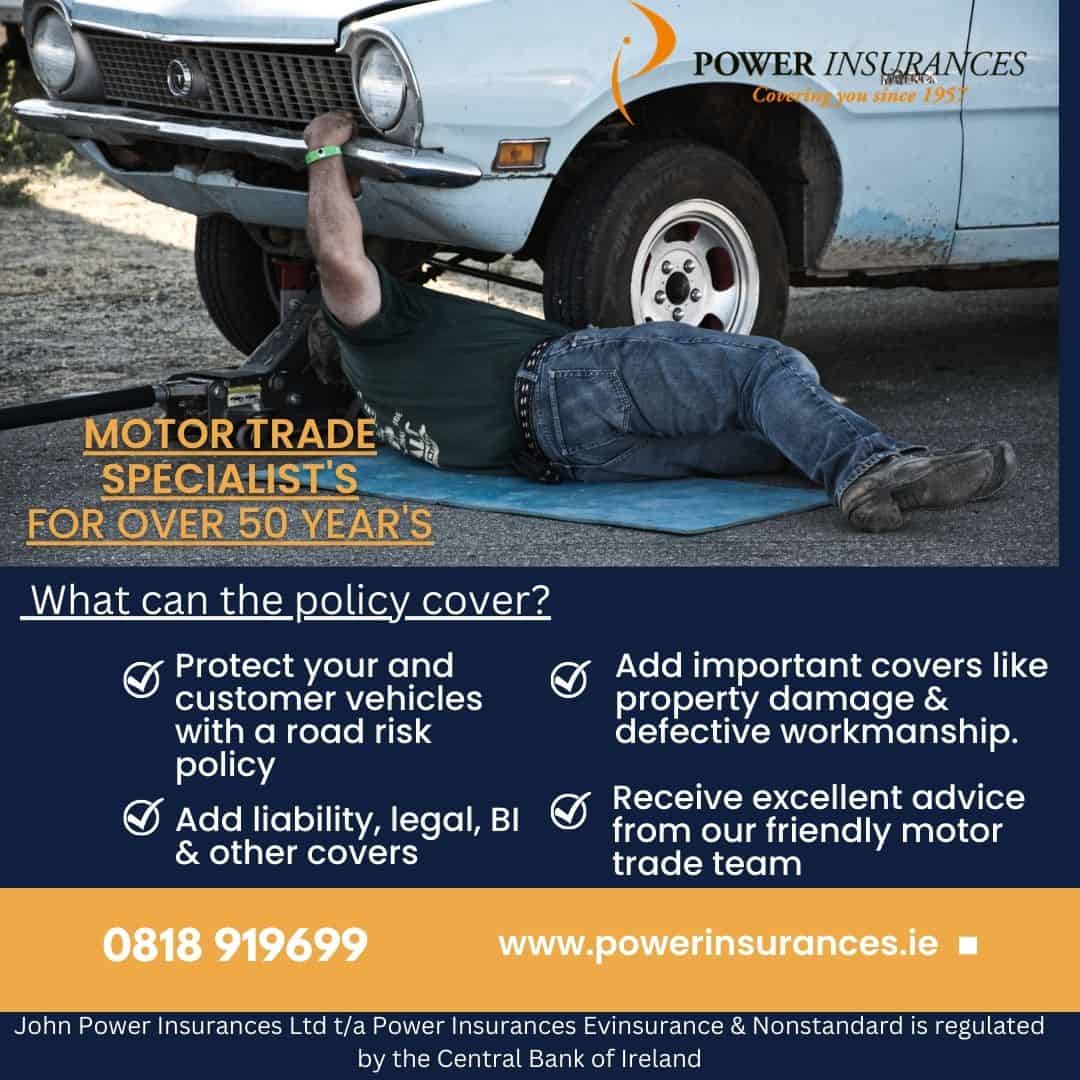

Vehicle trade insurance is an essential consideration for anyone managing a business in the motor industry, even if they are doing so from their residence. This specialized type of insurance not only provides coverage for vehicles and equipment but also defends business owners against possible liabilities. As more workers in the automotive sector embrace at-home operations, understanding the necessity of comprehensive motor trade insurance becomes essential for protecting their personal and business interests.

Understanding Automotive Trade Coverage

Automotive trade coverage is a unique type of insurance intended for people and companies involved in the vehicle sector. This coverage is essential for those who runs a vehicle trade enterprise, including mechanics, automobile retailers, and individuals working from home who might be delivering assistance like auto servicing or selling. It acts to protect against typical risks associated with managing vehicles, such as loss, stealing, or collisions while driving.

For individuals working from home in the motor trade, having the suitable motor trade insurance is crucial. It permits them to carry out their work without worrying about the financial repercussions of unforeseen occurrences. Unlike standard car insurance, motor trade insurance covers various vehicles and can include coverage coverage, ensuring that individuals working from home are covered when they are driving or working customers' automobiles. This level of coverage is not only functional but also critical for maintaining compliance with regulations that govern the automotive industry.

Moreover, motor trade insurance can provide versatility for those who function from home. Remote workers can tailor their coverage options to align with their individual business needs, whether they are managing a fleet of vehicles or just repairing a few vehicles for clients. This customization makes motor trade insurance an crucial resource for individuals juggling the demands of operating a company from home while guaranteeing they are sufficiently shielded against possible hazards.

Benefits of Motor Trade Insurance for Home Workers

Automotive trade coverage is crucial for home workers involved in the automotive industry, as it offers customized coverage for their unique situations. When operating remotely, especially in positions such as vehicle repair, selling, or servicing, having the necessary insurance ensures that both personal and business assets secured. This dedicated coverage can defend against dangers that typical home or personal vehicle insurance may not sufficiently cover, such as obligations associated with clients' vehicles or equipment used for business purposes.

Additionally, motor trade insurance allows home workers to operate with assurance. In the event of an event or harm to a customer’s vehicle, having thorough coverage provides peace of mind, knowing that they will not face devastating strains. This is particularly vital for those establishing their own automotive venture from home, as they often have limited resources and cannot bear to shoulder unexpected costs arising from incidents.

Furthermore, motor trade insurance can boost a home worker's credibility and standing. Clients are more likely to have confidence in a company that is properly insured, as it shows a resolve to functioning responsibly and protecting their assets. This can lead to increased customer confidence, return customers, and favorable recommendations, all of which are essential for growth in a domestic motor trade venture.

Choosing the Appropriate Motor Trade Insurance Policy

Selecting the appropriate motor trade insurance policy is important for anyone operating from home in the motor trade industry. Begin by evaluating the specific needs of your business. Consider aspects such as the variety of vehicles you handle, the scale of your operations, and whether you provide services like repairs, maintenance, or sales. Each category of activity may require different coverage options, so customizing your policy to fit your operations can cut costs and offer sufficient protection.

Afterward, compare different insurance providers to discover a policy that not only fulfills your criteria but also offers competitive rates. Look for trusted insurers with a proven record in the motor trade sector. Pay attention to the nuances of each policy, including coverage limits, exclusions, and any supplementary services such as roadside assistance or legal support. A comprehensive understanding of what each policy entails will help you formulate an informed decision that aligns with your business goals.

Lastly, think about seeking advice from insurance professionals who are experts in motor trade policies. They can provide perspectives into the most effective coverage for someone operating from home and help clarify any questions about terms and conditions. Utilizing their expertise can aid you avoid common pitfalls and guarantee that your motor trade insurance delivers you with peace of mind as you operate your business from home.